wa sales tax finder

Quickly learn licenses that your business needs and. The state sales tax rate in Washington is 6500.

Use the WA Sales Tax Rate Lookup app to find current Washington sales tax rates quickly and easily from anywhere you use your mobile device.

. Groceries and prescription drugs are exempt from the Washington sales tax. Washington has a 65 statewide sales tax rate but also has 179 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2373. Tax rate lookup mobile app.

Apply more accurate rates to sales tax returns. Find the TCA tax code area for a specified location. Lookup other tax rates.

--ZIP code is required but the 4. The Finder is a service offered by the Office of Information Technology OITDepartment of Administrative Services. If you have questions or concerns about information listed on The.

Whether youre on a job site delivering items. Whether youre on a job site delivering items. Lodging information and rates.

Once this app has cached the sale. Use this search tool to look up sales tax rates for any location in Washington. Groceries and prescription drugs are exempt from the Washington sales tax.

Local tax rates in Washington range from 0 to 39 making the sales tax range in Washington 65 to 104. Determine the location of my sale. WA Sale Tax Lookup is architected as a standalone application or microservice so that youre not dependent on the State of Washingtons IT infrastructure.

List of sales and use tax rates. The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. Use this search tool to look up sales tax rates for any location in Washington.

The Washington state sales tax rate is 65 and the average WA sales tax after local surtaxes is 889. Sales tax is based on the sellers location even if the seller delivers the items to. With local taxes the total sales tax.

Get information about sales tax and how it impacts your existing business processes. Tax rate change notices. Sales tax is based on the business location.

Sales of motor vehicles trailers semi-trailers aircraft and watercraft. The sales tax rates database is available for either a one-time fee or a discounted subscription that will provide you with monthly updates for all local tax jurisdictions in Washington. Use the WA Sales Tax Rate Lookup app to find current Washington sales tax rates quickly and easily from anywhere you use your mobile device.

The base state sales tax rate in Washington is 65. --ZIP code is required but the 4. Find Sales tax rates for any location within the state of Washington.

Account Id And Letter Id Locations Washington Department Of Revenue

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax Questions

Ivanka Trump Washington D C November 10 2017 Star Style Trump Fashion Trump Clothes Ivanka Trump

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

Pin On Android Apps For Muslims

10 Creative Ways To Use Instagram For Business Social Media Examiner Instagram Marketing Tips Instagram Social Media Infographic

Rsu Taxes Explained 4 Tax Strategies For 2022

S3solutions Can Help You Claim Back Any Overpaid Taxes In Bangalore India Http Www S3solutions In Indirect Tax Income Tax Tax Services

Sales Tax By State Is Saas Taxable Taxjar

Washington Income Tax Calculator Smartasset Com Travel Usa Seattle Ferry Bainbridge Island

How To Calculate Sales Tax For Your Online Store

10 Creative Ways To Use Instagram For Business Social Media Examiner Instagram Marketing Tips Instagram Social Media Infographic

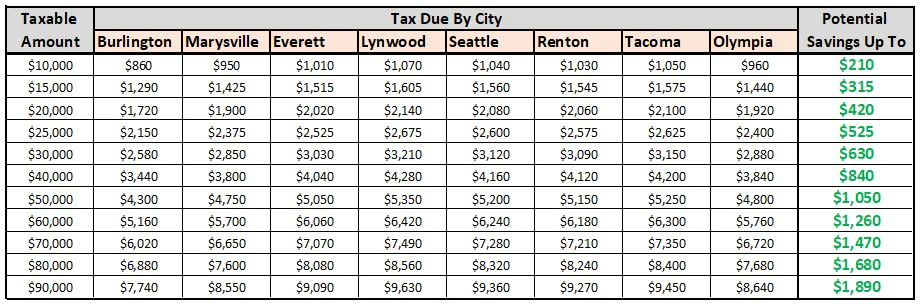

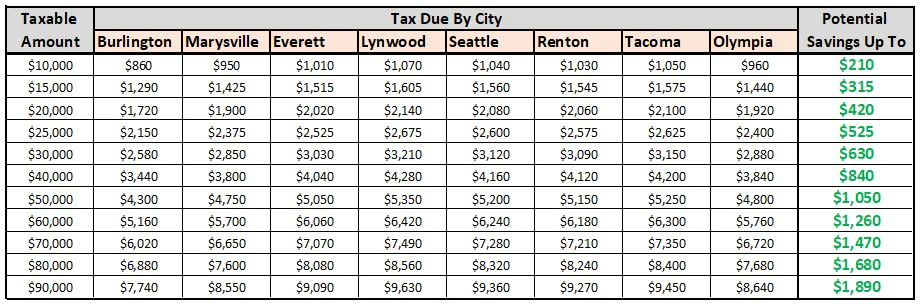

Auto Sales Tax Calculator Buy A Vw Near Marysville Wafacebook